Q3 GDP & The Impact From Aircraft Equipment

Aircraft equipment investment increased at a 429% annual rate in Q3, following a 647% annualized increase in Q2, a significant driver of overall GDP growth.

Nominal GDP increased at a 4.7% annualized rate in Q3, slower than the 5.6% growth rate in Q2 and slower than the 5.7% pace averaged over the prior four quarters.

The deceleration in nominal growth to a pace consistent with the pre-pandemic economy is mainly responsible for the shift in monetary policy from rate hikes to a long pause to rate cuts.

The deceleration in nominal growth is likely more intense than the headline numbers quoted above suggest.

As followers of EPB Research are aware, we focus on the “cyclical” component of GDP.

The “cyclical” component of GDP includes durable goods consumption, residential investment, and equipment investment.

The map below shows the breakdown from total GDP to the four primary buckets to the important subcategories, highlighting the three major buckets that make up the “cyclical” component of GDP.

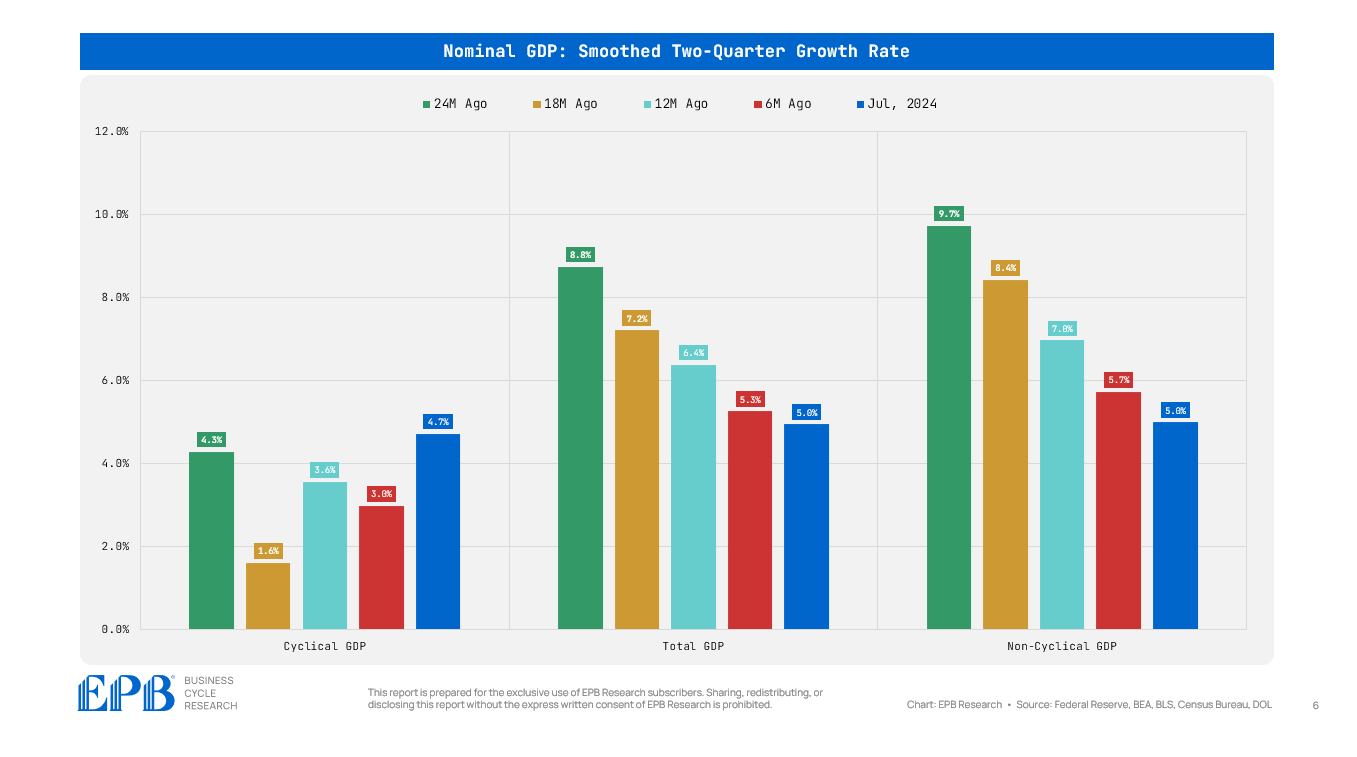

For the remainder of this post, I will quote growth figures as a “smoothed two-quarter annualized growth rate,” as this measure smoothes out quarterly volatility but moves faster than the slow-moving year-over-year figures.

The chart below highlights Cyclical, Total, and Non-Cyclical GDP and the growth rate from 24M ago, 18M ago, 12M ago, and 6M ago, as well as the most recent figures.

The middle panel shows total GDP decelerating from 8.8% growth two years ago to 5.3% 6 months ago to 5.0% most recently.

Cyclical GDP, the most important part of the economy and the segment responsible for all recessions has increased in growth rate, rising from 3.0% 6M ago to 4.7% most recently.

What accounts for this increase in Cyclical GDP growth, an area of the economy that is supposed to be negatively impacted by tight monetary policy?

The chart below shows the cyclical component expressed as a % of total GDP.

When the line moves lower, it means the cyclical part of GDP is underperforming the economy, a normal state during monetary tightening environments.

Cyclical GDP underperformed the economy significantly as the monetary tightening campaign started in 2022, falling from 18.1% to 17.0%, a 110bps decline over four quarters.

The most recent four quarters have seen this cyclical part of GDP perform in line with the broader economy, holding flat at 16.7%. This lack of underperformance from the cyclical part of the economy within the GDP numbers has fueled a narrative of economic resilience and assuaged recession fears.

Stability or in-line economic performance for the cyclical part of the economy is unusual in the context of tight monetary policy, so deeper digging is required.

The cyclical economy, as highlighted in the map graphic above, is comprised of durable goods consumption, equipment investment, and residential investment.

If we express each category as a % of GDP, we can see which category is underperforming or outperforming the broader economy.

Durable goods consumption and residential investment are clearly underperforming the economy, which is normal for monetary tightening regimes. Equipment investment never flinched during the entire tightening cycle, exploding higher in the most recent two quarters as well.

Business equipment investment has three primary components: computer equipment, industrial equipment, and transportation equipment.

Historically, transportation equipment is the most cyclical of these three categories, the one that normally declines the most during tightening cycles and contributes to recessions. However, we can see below how transportation equipment investment has sharply increased relative to GDP, an unusual outperformance during a tightening cycle.

Transportation equipment can again be divided between trucks/buses/autos, aircraft, or ships/boats/rail.

From 2022 through mid-2023, the auto sector was majorly backlogged and posted strong production numbers despite slowing sales.

However, the outperformance turned to underperformance over the last five quarters—the more usual trend during tightening cycles—as the backlogs cleared and the higher rates curtailed sales.

The big outlier is aircraft equipment, which more than doubled its contribution to GDP in two quarters, rising from 0.15% to almost 0.35%.

Ships/boats/rail investment increased as well, but only from 0.07% to 0.09%, not the same magnitude as the explosion in aircraft equipment.

Aircraft equipment investment makes up 2% of the cyclical part of GDP and 0.3% of total GDP.

So, if we strip out aircraft equipment investment from cyclical GDP, we are left with 98% of the cyclical economy, and if we strip out aircraft investment from total GDP, we are left with 99.7%.

The chart below shows a side-by-side comparison of nominal growth trends with and without aircraft investment.

Cyclical GDP moves from an accelerating trend and a most recent reading of 4.7% to a flat trend and a most recent reading of 3.3%.

So aircraft investment, which represents just 2% of cyclical GDP, was responsible for 30% of the growth in the most recent data.

Total GDP is reduced by 30bps in the most recent data after removing the impact of aircraft investment.

6% of nominal GDP growth was driven by a category that is just 0.3% in size.

You can also see just how outsized the contribution in the most recent quarter has been. The absolute difference in cyclical GDP growth (left) and the ex-aircraft cyclical GDP growth (right) has increased dramatically from 0.4% 24M ago, 0.2% 18M ago, 0.3% 12M ago, and 0.7% 6M ago to 1.4% in the most recent quarter.

Why is this so important?

Boeing has an ongoing strike at manufacturing plants.

Aircraft equipment investment increased at a 429% annual rate in Q3, following a 647% annualized increase in Q2.

These mammoth numbers likely represent a rush to produce equipment ahead of strikes.

While the plant is on strike, this will cause a drag in the same categories that are providing a huge outsized boost to GDP.

But even when the strike is resolved, these triple-digit production numbers will, of course, normalize, and the true trend in nominal growth will be more representative of the adjusted figures, which quote nominal growth below 5% on a smoothed two-quarter basis.

Nominal growth in the 4% range is back to the pre-pandemic regime.

As the future headline economic figures reflect this reality more strongly, the question of whether the “neutral rate” has shifted higher in the post-pandemic economy will re-emerge after it has been all but concluded in the context of these potentially illusory nominal growth figures in the last two quarters.

Before you go, please enter your email below to avoid missing a future update!!

And please feel free to share this post with anyone you think would find it valuable.

Whats the difference between the subscription service and the substack?