Sequential Signals of Recession

A modernized approach to a long-standing recession signaling system.

The Business Cycle moves with a consistent rhythm that stems from the nature of free markets and credit-based economic systems.

This rhythm, or sequence of events, has remained the same in each economic cycle over the last several decades in both inflationary periods and disinflationary periods.

Business Cycles track the progression of Aggregate Economic Activity through periods of expansion and periods of contraction. These transitions can take multiple years, but in recent decades, with the adoption of more ubiquitous trading schemes, the concept of Business Cycles has been molded around the desire to capture the random ebbs and flows of the stock market.

In 1980, Victor Zarnowitz and Geoffrey Moore, two pioneers of Business Cycle Research, proposed a signaling system based on the predictable rhythm or sequence of the Business Cycle. This system helps alert policymakers and business owners to the onset of recessions or the start of recoveries.

The original signaling system was based on Leading Indicators and Aggregate Indicators.

At EPB Research, we use a “Four Economies Framework” or four buckets of indicators to improve the granularity of the signals offered by the predictable Business Cycle Sequence.

In this post, we will improve upon the original signaling system by using Leading, Cyclical, and Aggregate Indicators of the economy. Then, we’ll review the system's historical performance and conclude with some comments about using the Business Cycle Sequence to your advantage.

The Baskets: Leading, Cyclical, Aggregate

The EPB Four Economies Framework separates the overall economy into four baskets or categories based on the timing of their movement within the Business Cycle Sequence.

As the name suggests, Leading Indicators are the earliest movers and contain monetary, credit, and some housing-related variables. These indicators are “soft” concepts as they don’t directly measure employment or economic growth but rather measure the availability of money and credit.

Cyclical Indicators measure employment and economic growth from the economy’s most cyclical or interest rate-sensitive sectors, which are generally residential construction, manufacturing, and the consumption of big-ticket consumer goods. So whenever you see “Cyclical Index,” that means employment and growth in construction and manufacturing.

Aggregate Indicators define the Business Cycle and directly measure employment and economic growth for all sectors of the economy. Most often, the Federal Reserve, financial media, and market pundits focus on these Aggregate Economy Indicators, but as our signaling system will show, changes in the Aggregate Economy are not informative about future conditions but rather descriptive of current conditions.

By monitoring a collection of Leading, Cyclical, and Aggregate Indicator baskets and studying their trends and growth rates, we are nearly assured that we’ll be alerted to economic downturns before they occur and economic revivals before they arrive.

As mentioned earlier, the concept of the Business Cycle has been molded into an attempt to create a precise stock market timing tool, but using this signaling system, or Business Cycles in general, for that purpose will yield dissatisfying results.

Let’s first examine the signaling system in action and then discuss how it can benefit asset managers, business owners, and corporate management teams.

The Sequence In Action

Leading Indicators provide advanced warnings about where the economy will go in the future.

With virtually no exceptions, all recessions start in the construction and manufacturing sectors, so these two sectors deserve special attention, which is our addition or improvement over the original Zarnowitz and Moore signaling system.

When the Aggregate Index turns negative, a recession is underway with no exceptions. Our signaling system will provide advanced warning of this occurrence.

This signaling system will provide three distinct signals: pending slowdown, pending recession, and recession.

The first signal, which we will call pending slowdown, defines a period when the economy is expected to grow below trend or to spot a potential pocket of weakness.

The first warning signal is triggered when the Leading Index falls below 2% growth and the Cyclical Index and Aggregate Index are both growing above 2%.

This signal tells us that in the future, the economy will transition from growing above trend or above 2% to growing below trend or below 2%.

This chart shows the periods when the pending slowdown signal was triggered.

After the Leading Index warns you of below-trend growth, the next signal defines actually arriving at that below-trend growth.

The second signal, pending recession, is triggered when the Leading Index falls below -1% and the Cyclical Index and Aggregate Index are both growing less than 2%.

This signal tells us that the economy is currently growing below trend, with both indexes that measure employment and growth less than 2% while the most forward-looking measure, the Leading Index, is contracting.

This chart shows the periods when the pending recession signal was triggered.

Signal three is the official recession signal, but at this point, significant problems have already hit the economy.

Signal three is triggered when the Leading Index, Cyclical Index, and Aggregate Index are all negative.

This chart shows the periods when the recession signal was triggered.

The official NBER recession dates aren’t known for well over a year, and the Federal Reserve, average economist, and average investor don’t realize the recession until it’s well underway.

The Lag Time

This signaling system is not intended to be programmed for algorithmic trading of the S&P 500. It is to be used as a guide and a tool for measuring and gauging the risk of economic downturns and economic revivals.

In real-time, economic data comes with revisions and changes that need to be taken in stride with some flexibility.

As the saying goes, the economy experiences long and variable lags, and that remains true with this signaling system.

In the 1990 recession, the pending slowdown signal provided 12 months advanced warning, and the pending recession signal provided 4 months advanced warning.

In the 2008 recession, lead times were radically different. The pending slowdown signal arrived in April 2006, almost two years before the official recession start date, and the pending recession signal was triggered 17 months before the recession start date.

With the benefit of hindsight, these were great signals that could have saved many business owners, asset managers, and financial institutions that were willing to give credence to the historically reliable Business Cycle sequence.

Sadly, not many took these advanced warnings due to a continued upswing in financial markets and prevailing optimistic sentiment, very similar to the euphoria experienced in 2023 and early 2024.

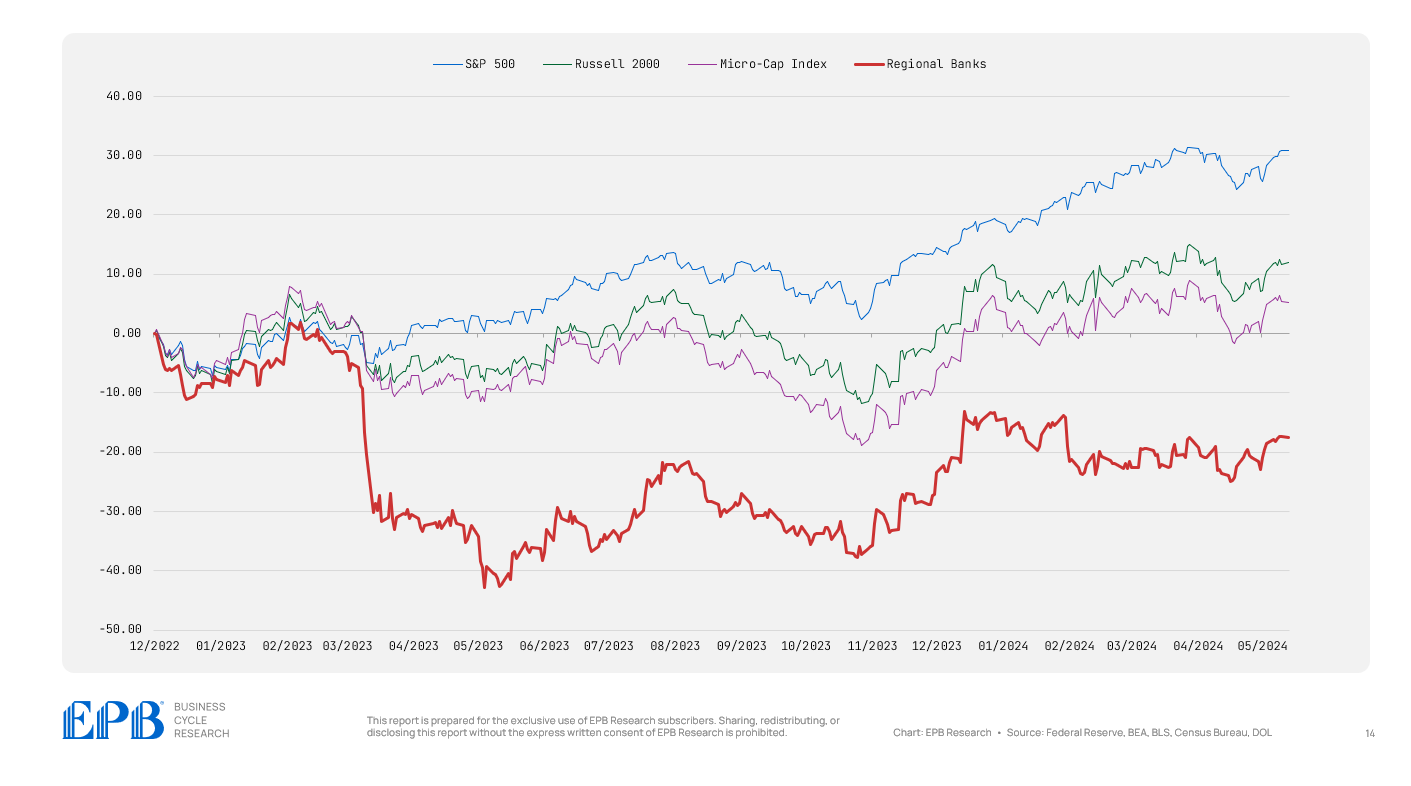

While the earliest signal was triggered in the spring of 2006 and the more important pending recession signal flashed by the fall of 2006, the S&P 500, Russell 2000, and Micro-cap stock indexes continued to rally, rising another 20%, providing endless fuel for tormenting anyone who dared offer a word of caution about the economic reality.

Quietly, the bank stocks were no longer rising to new highs, but this was ignored in favor of the broader market narrative.

The pending slowdown signal started flashing in the summer of 2022, and the pending recession signal has been on alert since December 2022.

Similar to the 2008 Business Cycle, the S&P 500 has rallied strongly since the pending recession signal started flashing but the underlying performance of other major indexes is not as robust. The Russell 2000 and Micro-cap stock indexes have increased but to a much lesser extent and very similarly, there’s been negative performance of bank stocks – but this time the pain is in the smaller banks compared to the money center banks.

It’s worth noting that the Russell 2000 index and Micro-cap index have not reached a new peak since 2021.

It's possible that the current pending recession signal could reverse without a full economic downturn occurring. This has not happened in the last six decades, but we must reserve that as a possibility.

For now, the pending recession signal has been flashing since the end of 2022, warranting caution for anyone using a Business Cycle approach.

The most important concept to remember from a Business Cycle approach is time alone does not negate a signal. A recession has not been avoided because a lot of time has elapsed if the signaling system is still flashing.

If the Leading, Cyclical, and Aggregate Indicators change course, then all bets are off, and a new outlook is established. A lapse in patience is often a fatal flaw in the Business Cycle.

Using The Business Cycle Sequence

As mentioned earlier, the Business Cycle, this signaling system, and the overall EPB Framework should be used as a tool or a guide for measuring economic risks.

Our framework, this signaling system, or any other approach will not provide you with tops and bottoms in the stock market despite what any marketing materials might suggest.

Harnessing the opportunities provided by the Business Cycle requires something more similar to a patient Warren Buffett approach to operating a business or investment portfolio rather than a high-frequency trading system that is given much more coverage in today’s media.

While not everyone can come up with a sophisticated trading system, anyone can monitor the slow-moving and predictable rhythm of the Business Cycle and use the information as a guide to better the long-run performance of business operations or investment decisions.

Click the link below to learn more about our Business Cycle Research services.

Great piece, thanks! I particularly like "A lapse in patience is often a fatal flaw in the Business Cycle".

So since 1970, the current #1 + #2 has always led to a recession. Can you, in broad terms, explain how you have adjusted your portfolio exposure due to this reality?

I watched the YouTube video but appreciate being able to ponder the newsletter format. Thanks Eric!