Stock Prices As A Leading Indicator? Not Anymore.

Analyzing the change in the leading nature of stock prices and outlining a better warning signal of future declines in earnings and share prices.

Stock prices have long been deemed a Leading Indicator of the economy and are still in popular indexes such as the Conference Board Leading Index.

However, the relationship between stock prices, earnings, and real economic conditions has changed over the last several decades.

In this post, we’ll highlight the changes in these relationships and underscore a better leading alternative for the economy, earnings, and potential declines in share prices.

Earnings, Share Price Declines & The Economy

S&P 500 earnings data, provided by Case-Shiller, show an increasing trend over time, with large declines that surround Business Cycle recession periods.

At times, such as from 2015 to 2016, earnings can dip, but without the follow-through of a Business Cycle recession, earnings recover and continue upwards.

The history of S&P 500 earnings shows the majority of declines associated with recessionary periods, marked with a red circle in the chart below.

Over the last 50 years, there have been four declines in earnings greater than 5% that were not associated with recessions. These periods are marked with an orange circle.

If we overlay declines in the share price of the S&P 500 with declines in earnings, we can see that before the 1990s, declines in share prices would often lead or anticipate declines in earnings and the economy.

In every Business Cycle recession, S&P 500 share prices led declines in earnings - marked with a red circle.

There were several periods when stock prices declined without a decline in earnings - marked with a green circle.

So stock prices would always lead major declines in earnings and sometimes, share prices would decline without a drop in earnings, or, stated another way, stock prices would sometimes anticipate declines in earnings that would not materialize.

However in the two modern recessions of 2001 and 2008, stock prices did not lead the declines in earnings - in fact, there was a slight lag of share prices relative to earnings.

Even in the 2016 mid-cycle downturn, there was a decline in earnings for almost a year before stock prices responded. Ultimately, the Business Cycle did not end, earnings recovered, and stock prices rebounded.

Stock prices had a very mild lead ahead of the 2022 decline in earnings, perhaps due to the rapid change in interest rates, but the main point still holds that stock prices used to have a far greater and more consistent lead ahead of earnings and economic declines compared to today.

Several theories can explain this change.

First, the S&P 500 is comprised of more service sector companies today rather than industrial companies. In addition, the structure of the stock market has become more passive and less active. Therefore, there’s less of an influence of market participants seeking to anticipate declines in the economy rather than blindly adding buying pressure.

More explanations likely exist, but there’s little debate that the leading nature of the largest stock index has changed over the years.

This dynamic has led to poor economic theories such as “the stock market now drives the economy.” This theory makes little sense as declines in earnings have been preceding declines in stock prices. So what, then, is driving the decline in earnings?

Earnings & The Four Economies Framework

Large declines in earnings still have dramatic impacts on share prices, but given this changing relationship, many are left using stock prices to predict economic declines which predict stock prices? This is rather circular.

At EPB Research, we use an Aggregate Economy Index to define real economic conditions. This index is comprised of the exact same variables the NBER uses to date Business Cycles including total nonfarm payrolls, total personal consumption and real personal income. These are the biggest and broadest measures of real economic performance and the peaks and troughs of this aggregated index define the Business Cycle.

As noted above, over the last 2.5 decades, earnings have been leading share prices for the most part.

In the chart below, it is clear that changes in real earnings occur slightly before peaks in the Aggregate Economy Index.

At EPB Research, we describe and track what we call a “Four Economies Framework.”

While the Aggregate Economy Index tracks the entire economy, there are some segments that move before the average, and some segments of the economy that move after the average.

In this chart below, we show this Four Economies Framework with the Aggregate Economy highlighted in yellow.

What this shows is that there are two buckets of economic data that move ahead of the Aggregate Economy data.

The Leading Economy does not track actual measures of growth or employment, but rather seeks to track the availability of money and credit, as well as soft commitments like building permit applications or new manufacturing orders.

The Cyclical Economy measures growth and employment for the two most interest rate and credit sensitive sectors: construction and manufacturing.

The Aggregate Economy, as the name suggests, tracks the broadest measures of growth and employment.

Lastly, the Lagging Economy, measures growth and employment of services - the least interest rate sensitive sector.

Changes in the Cyclical Economy (construction and manufacturing) are always first to respond to changes in the Leading Economy or monetary policy conditions.

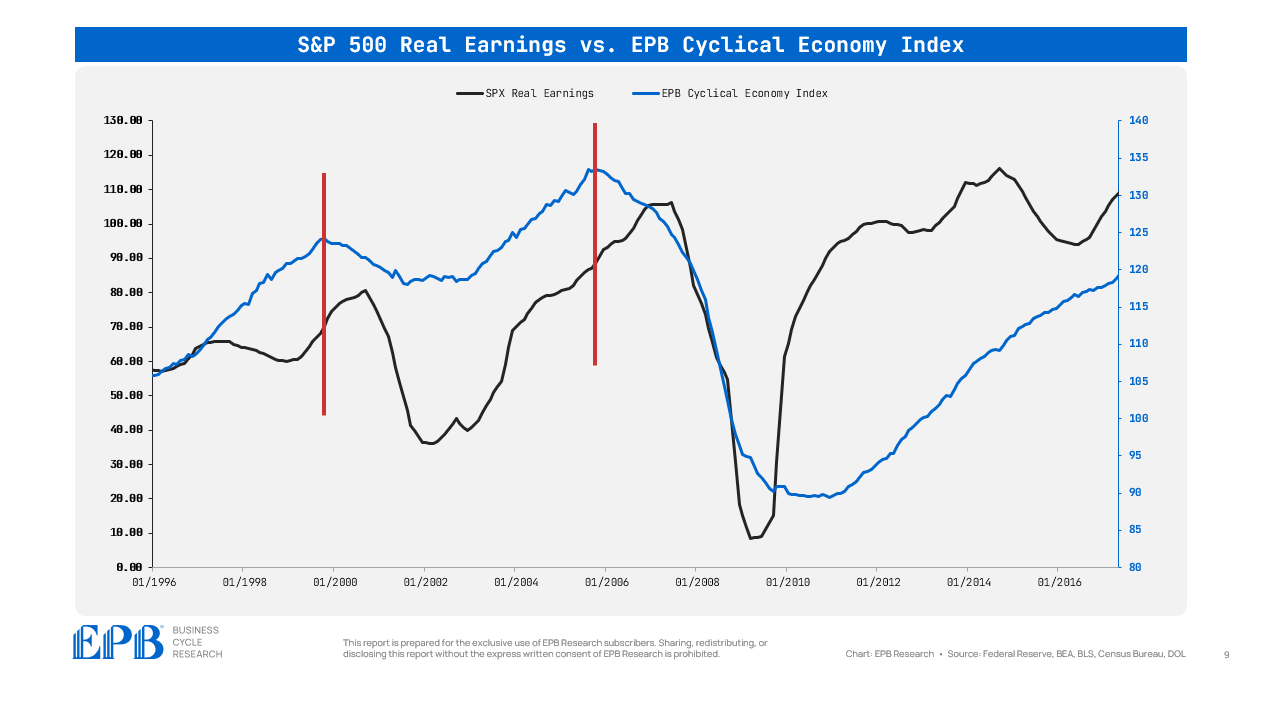

In the chart below, it’s clear how the Cyclical Economy Index of construction and manufacturing turned down far in advance of S&P 500 real earnings in the last two Business Cycle recessions of 2001 and 2008.

Changes in the Cyclical Economy lead to changes in earnings, which, lately, have led declines share prices.

Therefore, it is clear that the most important part of the economy to track is the Cyclical Economy or the construction and manufacturing sectors.

Tracking the Cyclical Economy and this Four Economies Framework is something that we do each month in the EPB Business Cycle Trends Report.

Of course, as the saying goes, there are long and variables lags between each Economy or each bucket of economic data.

On average, a 6-8 month time gap exists between each economic bucket, but these averages have variables ranges. For example, in the 2008 recession, the Leading Economy and the Cyclical Economy peaked around the same time, in the summer of 2006. This was about 1.5 years before the onset of the Aggregate Economy recession.

In the 2001 recession, the lead time of the Cyclical Economy peak to the Aggregate Economy peak was shorter than a year.

In this cycle, the time delay between the peak in the Leading Index was almost two years ahead of the Cyclical Economy due to a variety of pandemic-related factors.

Still, despite popular talking points, the Sequence of the cycle remained the same as it has in every Business Cycle.

In summary, stock prices, particularly the price of the major indexes like the S&P 500, are objectively poor leading indicators of the economy and earnings in the modern era.

However, changes in growth and employment of the most cyclical sectors remain a key warning sign of changes in earnings and broader economic activity.

Despite the shrinking relative size, don’t lose sight of the Cyclical Economy.

If you found this post interesting, please share it, and don’t forget to enter your email below so you receive the next article in your inbox!

Click the link below to learn more about our Business Cycle Research services.

“the stock market now drives the economy” - investors who believe this would argue that the link between equities and the economy is the (1) wealth effect which the Fed began focusing on under Bernanke, and (2) financial conditions which also became a greater focus under Bernanke due to the impacts of changes in the Fed's balance sheets on treasury yields, corporate bond yields, equities, and other areas of the financial markets. As evidenced above, this is a phenomenon that has been in existence since the GFC and relates to Fed balance sheet policy. I'm a fan of your cyclical economy framework but I don't believe your appreciating the link between equities and the economy being a more modern phenomenon.