The Post-COVID Business Cycle (Chart Of The Week)

Our featured chart from the EPB Weekly Economic Briefing / Week 30

The Duncan Leading Index, or in this case, the modified Duncan Leading Index, takes the Cyclical component of GDP expressed as a percentage of final sales.

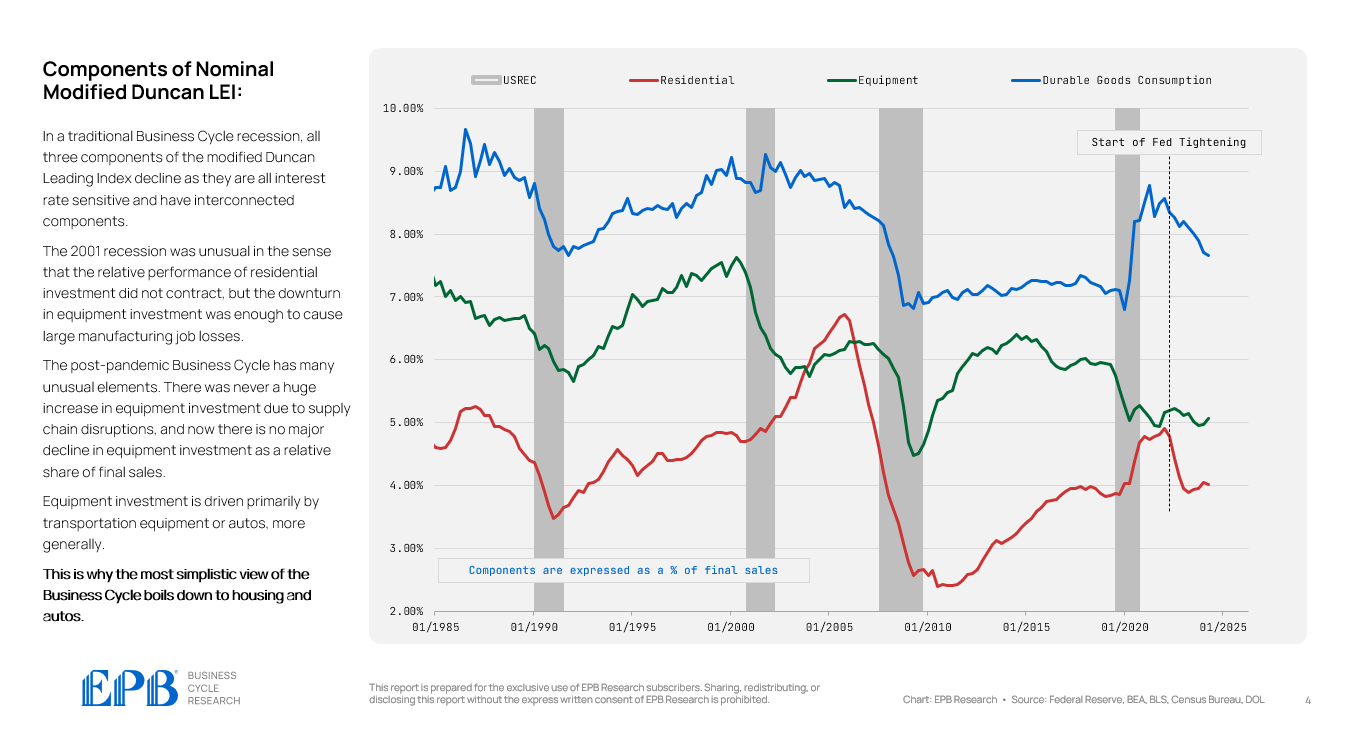

The “Cyclical” component of GDP includes residential investment, business equipment investment, and durable goods consumption.

In a traditional Business Cycle recession, all three components of the modified Duncan Leading Index decline as they are all interest rate sensitive and have interconnected components (see 1990 and 2008 recessions).

The 2001 recession was unusual in the sense that the relative performance of residential investment did not contract, but the downturn in equipment investment was enough to cause large manufacturing job losses.

The post-pandemic Business Cycle has many unusual elements. There was never a huge increase in equipment investment due to supply chain disruptions, and now there is no major decline in equipment investment as a relative share of final sales.

Equipment investment is driven primarily by transportation equipment or autos, more generally.

This is why the most simplistic view of the Business Cycle boils down to housing and autos.

After the pandemic, auto demand spiked but there was no ability for production.

Now, auto demand is cooling but auto production is surging, moving out of sync with the broader Cyclical economy.

It’s impossible to make the case that auto production is accelerating because monetary policy is too easy.

This is clearly a result of still-ongoing production issues in the aftermath of the pandemic.

This chart and analysis were featured in the EPB Weekly Economic Briefing, Week 30.

To learn more about our Business Cycle Framework and our Weekly Economic Briefing reports, click the link below.

All our reports are presented in animated video format, which requires minimal effort to consume, so you can save time and focus on what you do best.

Year to date auto production here in the UK announced Thursday dropped further, from an 11.9% fall in May to 26.9% in June. We were told in February when the fall started it was down to manufacturers re-tooling for new EV models. Seems a bit of a stretch to accept this is still the case as we are still being told 6 months on.