The State of US Manufacturing

Analyzing the depth & duration of the contraction in US manufacturing production and employment.

Next to residential construction, the manufacturing sector is the most influential determinant of the Business Cycle.

It’s often suggested that the manufacturing sector’s shrinking relative size has lessened the influence in determining the fate of the Business Cycle, but that declaration is incorrect.

Moreover, it’s been postulated that the US economy has remained resilient in spite of a multi-year contraction in US manufacturing activity. That, too, is incorrect.

The US economy has remained resilient due to a lack of contraction in manufacturing activity.

Let’s explore.

At EPB Research, we aggregate Coincident Indexes of various sectors, including manufacturing. The Manufacturing Coincident Index is a composite of production and employment for the manufacturing sector - the truest measure of activity.

New orders, surveys, and sentiment measures have been poor for the manufacturing sector since 2022, all with a good history of foreshadowing contractions in activity, but the truest measure of production and employment has not yet soured.

The Manufacturing Coincident Index has stagnated since 2022, but declines have been minimal so far.

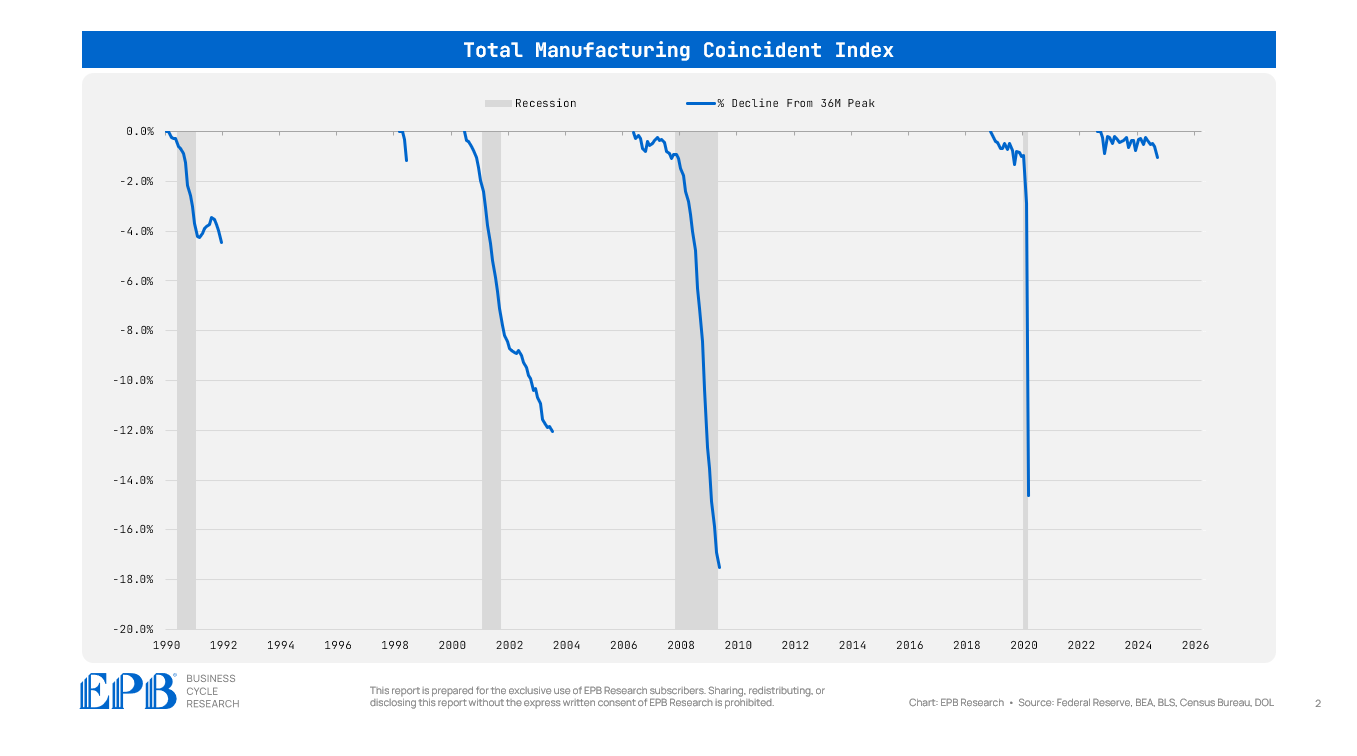

The chart below shows the percentage decline in the Manufacturing Coincident Index. Declines are cropped at the weakest point, and only declines exceeding 1% are shown.

The Manufacturing Coincident Index declined more than 4% in the 1990 recession, roughly 12% in the 2001 recession, and nearly 18% in the 2008 recession.

Today’s decline in manufacturing activity has hardly exceeded 1% despite beginning in late 2022.

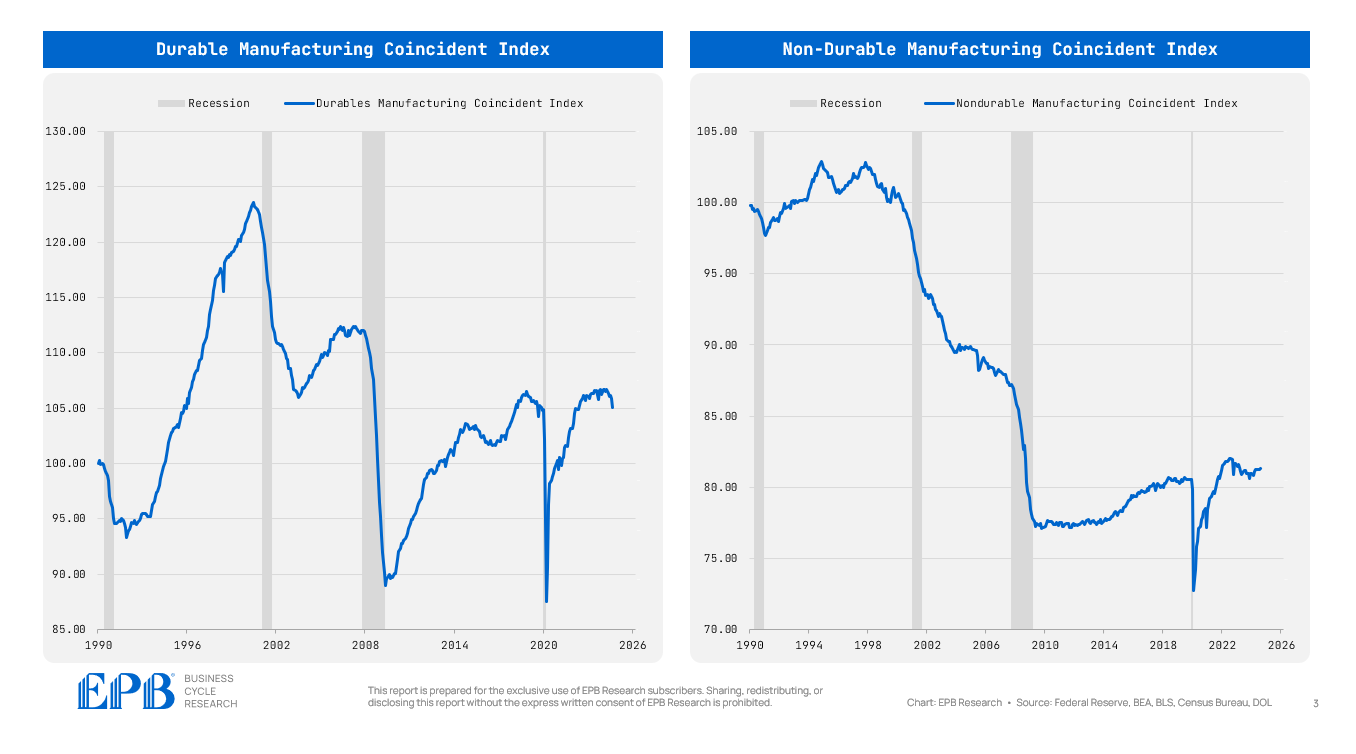

The manufacturing sector can be split into two categories: durable manufacturing and non-durable manufacturing.

Durable manufacturing is most important for the Business Cycle, consisting of industries like motor vehicles, heavy machinery and primary metals.

Non-durable manufacturing is far less critical, consisting of food, beverages, tobacco, clothing, and more.

Of course, both manufacturing categories have experienced secular declines, but that does not change the cyclical impact driving the ebbs and flows of the overall Business Cycle.

The chart below shows the percentage decline for the Durable Manufacturing Coincident Index and the Non-Durable Manufacturing Coincident Index.

The Durable Manufacturing Coincident Index declined 7% in the 1990 recession, almost 15% in the 2001 recession, and more than 20% in the 2008 recession.

Soft landings occurred after declines of roughly 2% in 1998 and 2016.

Today, the Durable Manufacturing Coincident Index has declined 1.5%, starting just six months ago, and much of that decline is from the October Boeing Strike.

The decline in the Non-Durable Manufacturing Coincident Index started in late 2022, but the durable sector is the more important swing factor.

Many consider measures like new orders, sentiment surveys, and PMIs to be gauges of actual manufacturing activity, but these indicators do not measure actual production and employment.

These measures have a place and are popular leading indicators, properly foreshadowing the declines we are starting to see in the manufacturing sector today, but it’s not accurate to suggest the economy has been withstanding a brutal manufacturing decline when the reality suggests only fractional contractions in the Coincident Indexes.

This Business Cycle has been unusual and difficult because traditional leading indicators like new orders have been declining since 2022 and remain quite weak, but actual activity has not declined to the same extent.

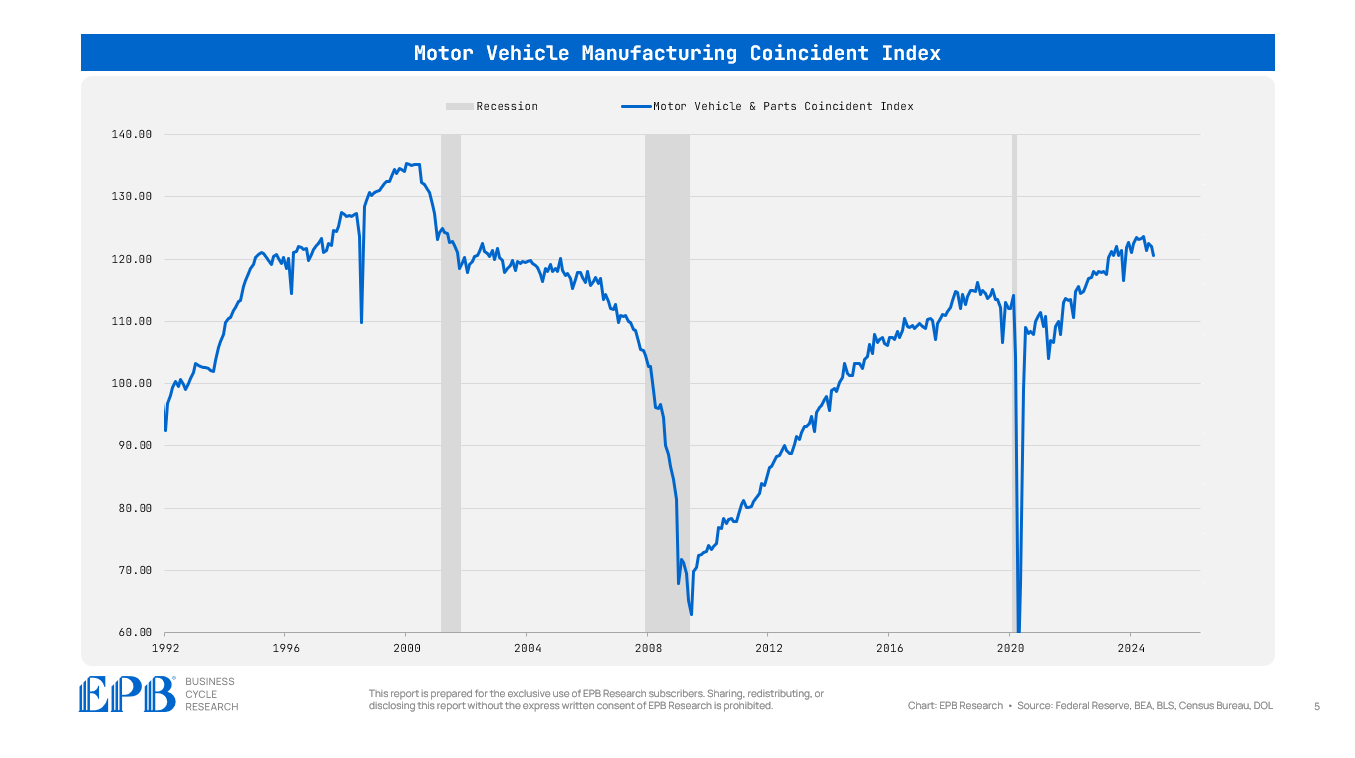

In 2021 and 2022, new orders exceeded production by such a large amount, that multiple years worth of backlogs were created that allowed production and employment to continue without a continued flow of new orders.

This phenomenon is evident perhaps most strongly in the motor vehicle manufacturing sector, which saw a major increase in coincident activity in 2023 and 2024, feeding off production backlogs accumulated in 2021 and 2022.

Most leading measures of manufacturing activity remain weak, and production backlogs are wearing thin in most sub-categories, which is why the Coincident Indexes, particularly the durables index, are starting to contract after an unusually long lag time.

The economy has not remained resilient in spite of a contraction in manufacturing; the economy has remained resilient because of a lack of contraction in manufacturing.

It’s far from coincidence that the Federal Reserve shifted from rate hikes to a long pause to rate cuts as actual manufacturing activity moved from expansion to the beginning of a contraction.

If you found this post interesting, please share it, and don’t forget to enter your email below so you receive the next article in your inbox!

Click the link below to learn more about our Business Cycle Research services.

Great work!

Eric as insightful, easy to understand, and compelling as usual