The Two Most Important Labor Market Sectors

Analyzing the two biggest sectors that drive the overall labor market.

Analyzing the labor market is the most important component of the economy since job losses are integral to the recessionary process.

Not all sectors of the labor market are equally important, and the biggest sectors are not necessarily the key swing factors.

For example, it’s common to suggest that manufacturing is no longer critically important as it has become a smaller and smaller component of the labor market, with manufacturing payrolls representing only 9% of private sector jobs - but the reality is this sector punches far above it’s weight.

In this post, we’ll analyze the top 10 sectors of the labor market and reveal the most important drivers that you should focus on in determining the health of the employment market and overall economy.

The Top 10 Sectors

The labor market can be divided into government jobs and private-sector jobs. For this analysis, we are only discussing private-sector jobs.

The private sector can be broken into the following 10 labor market sectors:

Mining & Logging

Construction

Manufacturing

Trade, Transportation & Utilities

Information

Financial Activities

Professional & Business Services

Private Education & Health

Leisure & Hospitality

Other Services

The “services” economy is most often discussed when thinking about the labor market or the broader economy, including sectors like Lesuire, Hospitality, Education and Healthcare.

But are these sectors responsible for driving the booms and busts in the labor market?

In the charts below, we’ll look at the percentage decline in total jobs for each sector around all recessionary downturns (excluding the 2020 COVID recession).

Percentage Declines

Mining and Logging is a highly volatile labor market sector with declines that are not always perfectly associated with Business Cycle recessions.

Construction is a volatile sector with declines that are highly correlated to Business Cycle recessions.

Job loss downturns in construction have ranged from 2% to almost 30%, with an average clustered around 10%.

Manufacturing also has declines that are extremely correlated to recessionary periods, with a range of declines spanning from 7% to 18%.

Trade, Transportation, & Utilities is slightly less volatile than construction and manufacturing, but the declines are correlated nicely with the economic downturn periods.

The information sector, which contains technology jobs, experienced a very big bust in the 2001 recession, with the sector losing nearly 16% of its total payrolls. Today’s decline has stretched to 4%, the largest among the 10 sectors so far.

Generally, the financial sector is not highly volatile, with hardly any job losses except for the 1990 and 2008 recessions.

The 2008 crisis was heavily concentrated in the financial sector, and job losses stretched to more than 8% of total payrolls.

Professional & Business Services is not overly volatile, but job losses are highly correlated to recessionary periods and have increased consistently in the last three Business Cycles (1990, 2001, 2008).

Education & Health payrolls are not volatile and virtually never decline. When declines occur, they are minimal. The pandemic was a clear outlier, and the declines lasted only briefly.

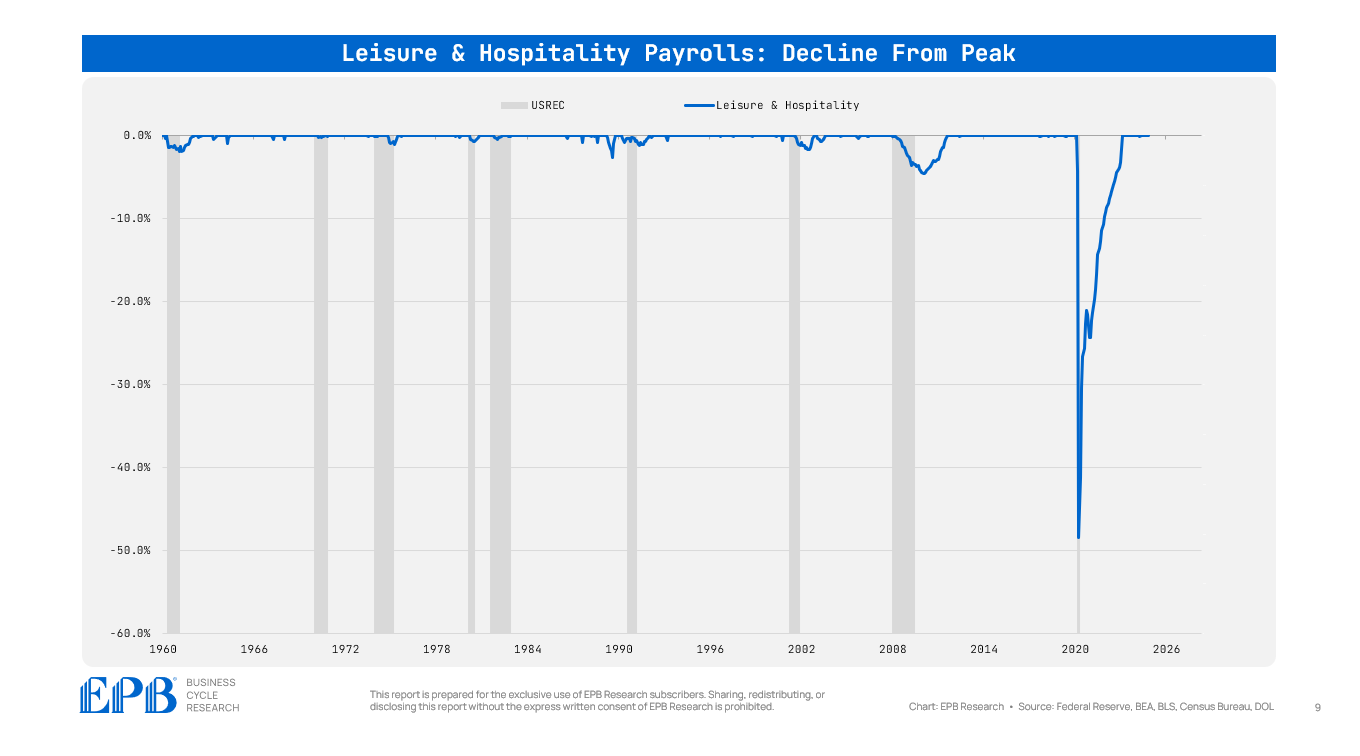

Leisure & Hospitality collapsed during the pandemic, but aside from that mandated recession, payroll declines averaged about 1%, reaching 5% only in the deep 2008 recession.

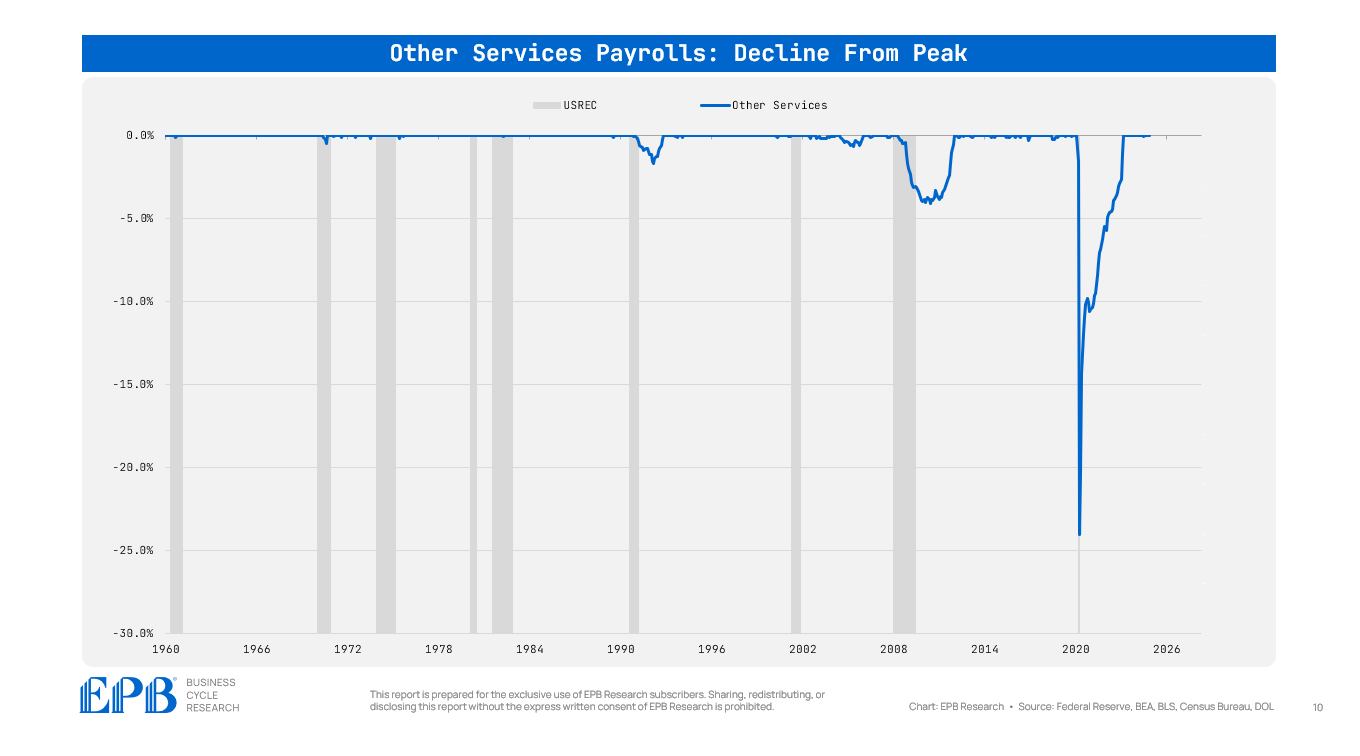

All remaining jobs are bucketed into Other Services, which are not meaningfully volatile. Many downturns had no decline in Other Services payrolls, with the 2008 recession reaching just 4%.

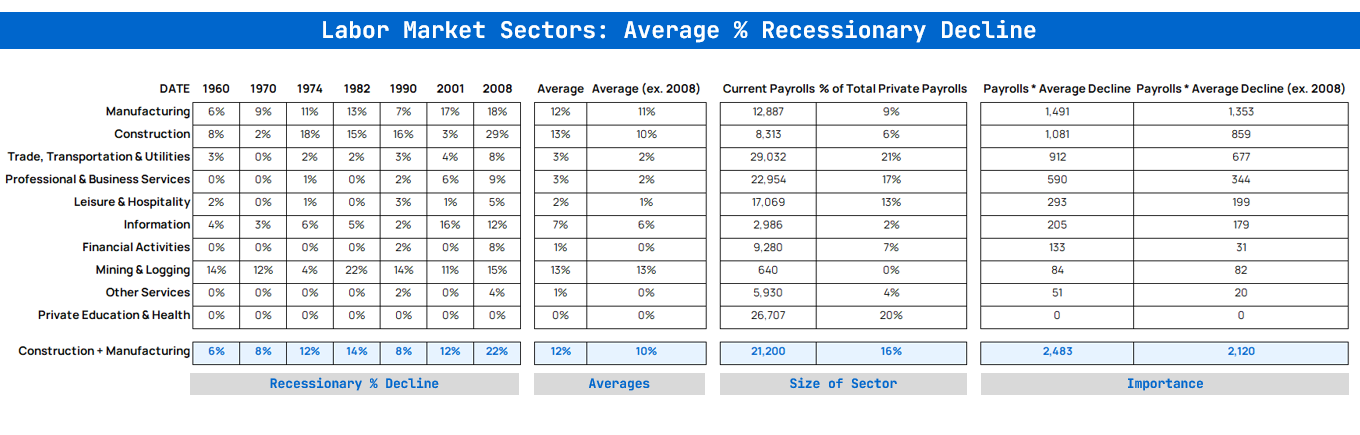

So, when we put all these sectors together and list the average recessionary declines, we can rank the sectors responsible for driving the downturns in the overall labor market.

Order of Importance

In the last 7 recessions, manufacturing jobs declined 12% on average.

Manufacturing currently has 12.9 million payrolls, representing just 9% of the private sector.

But an average 12% decline on 12.9 million payrolls equates to 1.5 million jobs.

We can do this back-of-envelope analysis for the top 10 labor market sectors to rank order the relative importance.

Manufacturing and construction are still the two most important sectors of the labor market, even though currently they represent just 16% of private sector payrolls.

This is why, at EPB Research, we focus intently on the dynamics in manufacturing and construction, what we call the “Cyclical Economy,” in our research services.

Trade, Transportation & Utilities ranks third, followed by Professional & Business Services fourth.

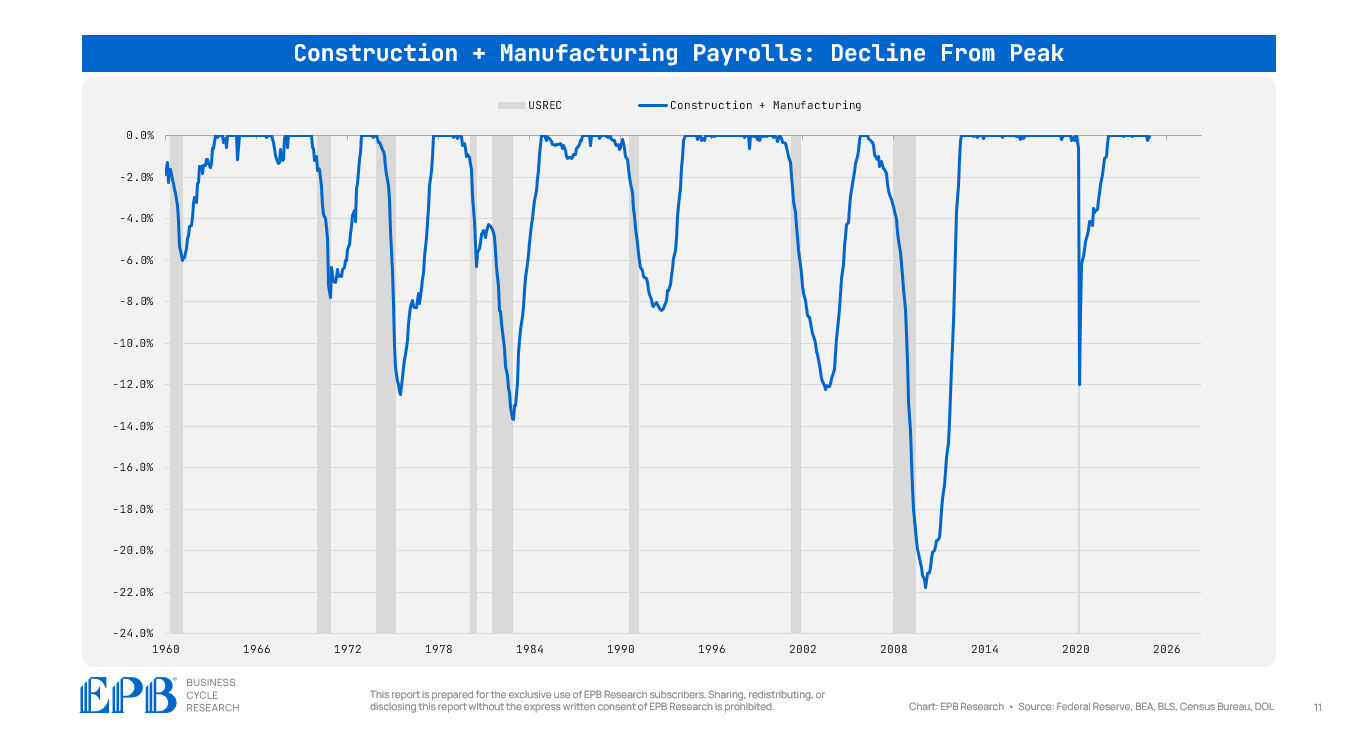

The chart below shows the combination of construction and manufacturing payrolls and the percentage decline around economic downturns.

These sectors have not lost any cyclicality or volatility in more modern downturns. They have lost size but not cyclicality.

Even at the current size, the amplitude or the swings in these two sectors is the overwhelming driver of the ups and downs in the labor market.

If every sector had an *average* decline in payrolls, based on history, construction and manufacturing would still represent 52% of all job losses despite being just 16% of the total size.

Don’t let the shrinking size of these sectors convince you that they are less important to the overall economy.

If the economy has a downturn in construction and manufacturing jobs, it will still be extremely difficult to avoid a recession.

However, without a downturn in these two sectors, no other sector will be able to have enough force to create a downward spiral.

If you found this post interesting, please share it, and don’t forget to enter your email below so you receive the next article in your inbox!

Click the link below to learn more about our Business Cycle Research services.

Is government employment covered in this analysis because it seems headed for a big decline?

Hi Eric,

Not sure if the charts are there and I can not see them or perhaps there are not there?