The Cyclical Economy: The Driver of Booms & Busts

The rise and fall of construction and manufacturing determine the strength of economic cycles.

In our last two blog posts, we introduced the EPB Four Economy Framework and analyzed the Leading Economy.

(Click here to read the Four Economy Framework Overview)

(Click here to read the post on the Leading Economy)

The economy moves in a predictable sequence, and we break this sequence into four steps or “four economies.”

The Leading Economy gives us an early warning sign of future changes in growth and employment by tracking various measures such as real money supply growth, the yield curve, and new home sales.

Next is the Cyclical Economy, which is the focus of this post.

The Cyclical Economy: The Engine of Growth

The Cyclical Economy is the first time we measure growth and employment directly, but only for the construction and manufacturing sectors, as these two industries are the most sensitive to changes in monetary policy and have the largest booms and busts.

In the Leading Economy, we looked at monetary measures and some measures of sales volume for key Cyclical Economy goods like homes and trucks.

The Cyclical Economy directly measures the growth or production of those goods and employment needed for the production of those goods.

The Cyclical Economy is the engine of growth or the pulse of the economy. The rise and fall of construction and manufacturing determine the strength of economic cycles.

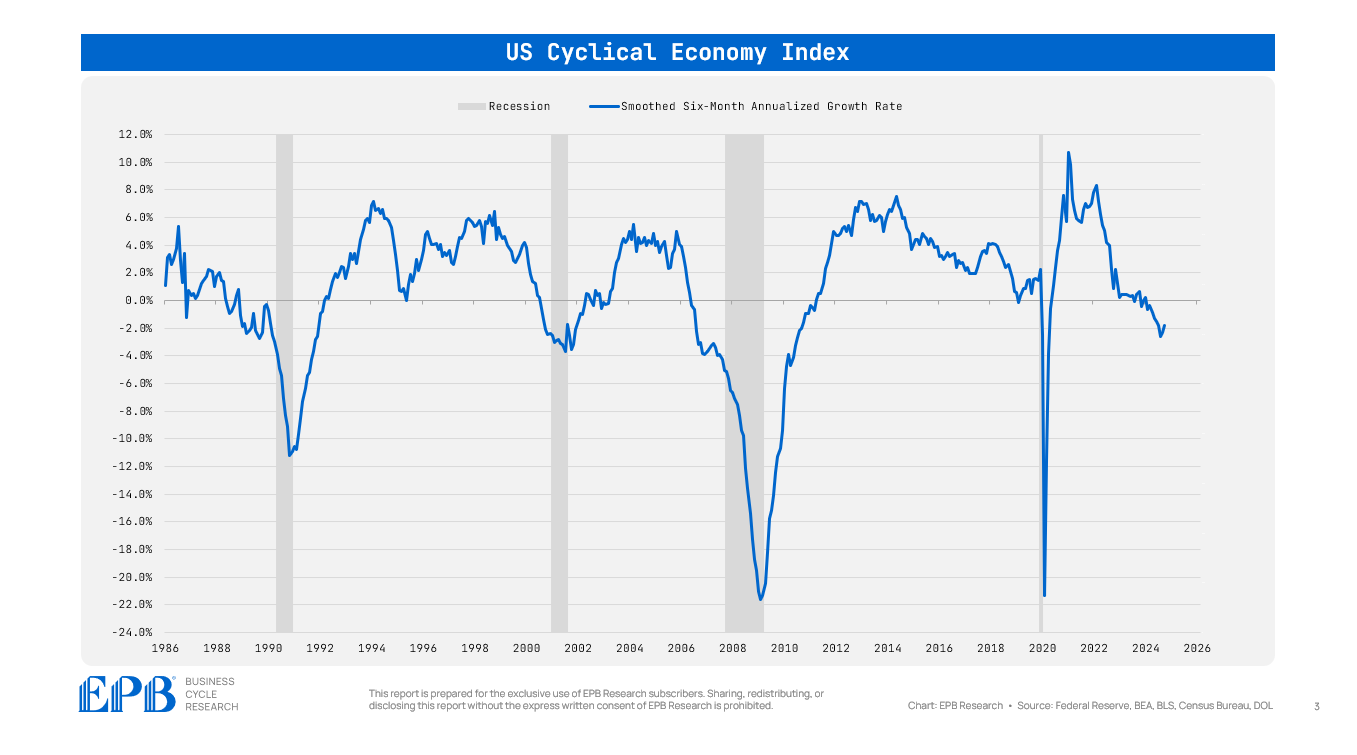

This chart shows the Cyclical Economy Index, a measure of production and employment, and the peaks can be clearly seen leading all major recessionary periods.

Furthermore, the peak-to-trough declines in the Cyclical Economy are perfectly correlated to the magnitude or severity of the recessionary period.

The 2001 recession was the mildest because there was a small contraction in the Cyclical Economy sectors, while the 2008 recession was massive, with a 30% decline in these key sectors.

It’s often said that the Cyclical Economy sectors of construction and manufacturing don’t matter as much anymore as they are becoming a smaller and smaller share of growth and employment.

While it’s true that these sectors have become a smaller share of the economy over time, these sectors have extreme cycles, often declining 10%, 20%, or even 30% in a recessionary period.

The amplitude or swings in annual growth rates have ranged from +10% to -22% over the last several decades.

One of the biggest misconceptions in the post-2008 period is that the economy has avoided recession because it has been able to withstand declines in the Cyclical sectors.

This statement is empirically false and stems from a mismeasurement of the Cyclical Economy.

As the chart clearly shows, since the recovery after 2008, the Cyclical Economy has never declined, aside from the brief COVID lockdowns.

So it’s not that the economy avoided recession in spite of a downturn in construction and manufacturing; it’s very specifically because there was no downturn in construction and manufacturing.

The Leading Economy measures things like sales volume and new orders, and in that bucket, there were downturns and soft patches. However this bucket does not measure actual production or actual employment of these sectors.

When properly measured, it’s clear that there was no substantial downturn in the economy’s engine, and that is why the economy has not experienced a Business Cycle recession.

This is why breaking the economy into these four buckets and properly sequencing the economic data is so critical in having a detailed understanding of what’s going on in the overall economy.

The Cyclical Economy is the most important component of the Four Economy Framework.

Downstream Effects

It’s often misstated that the economy declines because consumers stop spending or that you need to wait for the services economy to slow down - the US economy is a services economy, after all, right?

Tightening of monetary policy impacts the Leading Economy. Once the Leading Economy turns down with enough magnitude and enough duration, the Cyclical Economy turns down, which means actual production and actual employment in key industries are falling.

Job losses that occur in the Cyclical Economy create downstream effects on services.

People who become unemployed in construction, manufacturing, and the tangential industries immediately stop discretionary spending and eventually may default on credit cards, auto loans, and home mortgages.

Banks then experience rising delinquencies and further contract credit, and only then do the services business experience a fall in revenues. At this point, the Federal Reserve and the broader public notice the trouble, but in reality, the sequence has been playing out for usually a few years.

As noted in the last Leading Economy article, many Leading Economy indicators peaked and started to decline in 2005 and early 2006.

The Cyclical Economy was in a clear downturn by early 2007.

The stock market continued to rise until October 2007 and was less than 10% from an all-time high in early 2008.

Today’s version of economic analysis would suggest that the wealth effect of rising stock prices is the most critical, and thus, it was only in late 2007 and early 2008 that “financial conditions” became tight and consumers pulled back as a result of declining assets, but in reality, the sequence was in place and playing out visibly since 2005.

The Four Economy Framework is designed to link the sequence of economic events into a clear picture of both current conditions and a future Business Cycle outlook.

Business Cycles play out over years, not months and quarters. Many are narrowly focused on stock prices and ignore or refute events that may transpire years before peaks in asset prices.

The goal is not to predict daily market movements or short-term economic swings but to determine how the sequence of the Business Cycle is moving step by step.

The Cyclical Economy is the most important component of the Four Economy framework, and further breakdown into the granular sub-sectors of construction and manufacturing is essential.

Within construction and manufacturing, a few key sub-sectors are the usual suspects in driving the booms and busts in the overall Cyclical Economy, such as residential construction and durable goods manufacturing.

Stay tuned for the next post in this series, where we break down the most important areas of the manufacturing industry, including durable goods and motor vehicle manufacturing.

After that, we’ll dive into the details within the construction sector before moving to the next step in the Four Economy Framework, the Aggregate Economy.

If you’re interested in this structured and repeatable process for tracking the Business Cycle, click the link to learn more about our Business Cycle Research package.

If you found this post interesting, please share it, and don’t forget to enter your email below so you receive the next article in your inbox!

Very clear and concise, thank you!

Thanks Eric, agree with Alan very clear and to the point! waiting for the next piece!