Residential Construction: The Backbone of the Cyclical Economy

Analyzing the impact of the residential construction sector on the overall Business Cycle

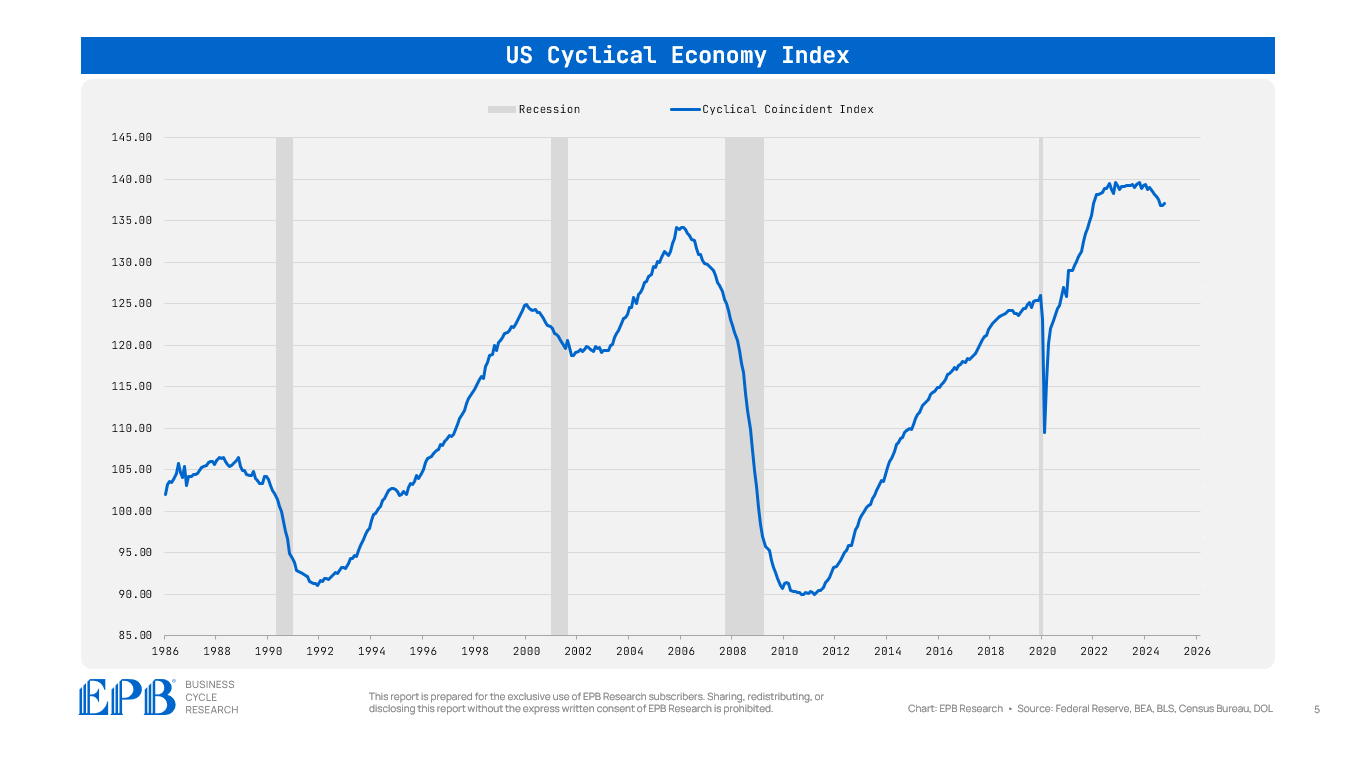

In the EPB Four Economy Framework, the Cyclical Economy is the engine of growth and the driving force behind all booms and busts in the economy.

In our first three posts, we outlined the Four Economy Framework, discussed the Leading Economy, and highlighted the importance of the Cyclical Economy.

The Leading Economy gives us an early warning sign of future changes in growth and employment by tracking various measures such as real money supply growth, the yield curve, and new home sales.

The Cyclical Economy is the first time we measure growth and employment directly, but only for the construction and manufacturing sectors, as these two industries are the most sensitive to changes in monetary policy and have the largest booms and busts.

The Cyclical Economy is the engine of growth or the pulse of the economy. The rise and fall of construction and manufacturing determine the strength of economic cycles.

In the fourth post, we discussed the details of the manufacturing sector and how durable goods manufacturing and motor vehicle manufacturing, most specifically, are the key drivers of the booms and busts within overall manufacturing.

In this post, we’ll focus on the second part of the Cyclical Economy - the residential construction sector.

Together, the manufacturing sector and the residential construction sector make up the Cyclical Economy - the most important of our Four Economy Framework.

Housing, Construction, & The Business Cycle

It’s often said that “Housing Is The Business Cycle.”

This statement is true. However, it requires an explanation and nuance.

As many of our readers know, the economy moves in a sequence with leading, cyclical, aggregate, and lagging data.

Since “housing” is generally considered a leading indicator, most people lump all housing data into the leading bucket, which is not accurate.

Building permits, the volume of new home sales, and the volume of existing home sales are leading indicators. These measures can move quickly based on changes in monetary policy. They can move in a matter of days.

After changes in the volume of sales and building permits, the construction process starts, and we measure the number of housing units being built or the dollars spent on residential construction.

We also track the amount of employment associated with this residential construction. The production and employment associated with residential construction is what we track in the Cyclical Economy and this is the part of the sequence where the statement, “Housing is the Business Cycle” applies.

If there’s a downturn or upswing in residential construction and employment, that is what really drives the broader economy.

After changes in construction, we can see changes in home prices, a lagging indicator often incorrectly lumped together with earlier data.

People often think home prices are a leading indicator and are thus frustratingly confused when prices lag the broader economy.

To summarize, building permits and new home sales are common and effective Leading Economy variables. You can read more on that here.

Residential construction activity and residential building employment are Cyclical Economy variables that are the most predictive of recessionary conditions, alongside the manufacturing counterpart that we discussed here.

The Cyclical Economy Put To Use

The Cyclical Economy is the driver of the overall economy. Upturns and downturns in the Cyclical Economy most often occur simultaneously in manufacturing and residential construction because these industries have many interconnected elements.

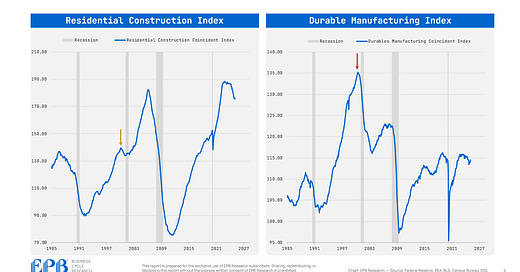

On rare occasions, like the 2001 business cycle, a downturn only occurs in one of the two critical Cyclical Economy industries, but that is less common. The chart below shows no sustained downturn in residential construction (-4.1%) during the 2001 recession but a major downturn in durable manufacturing (-13.9%).

So it’s worth tracking residential construction and manufacturing separately, as we commonly do, as well as in a collective Cyclical Economy Index which is a staple and key focus of our Monthly Business Cycle Trends Reports.

The entire Cyclical Economy Index takes production and employment for manufacturing and residential construction. This combined basket makes for the most effective single index in Business Cycle analysis.

There are even more detailed ways to slice this analysis that we incorporate in our Monthly Business Cycle Trends Reports.

Often, we look at residential employment and manufacturing employment together and residential production and manufacturing production together.

We call this “Cyclical Employment” and “Cyclical Production.”

Generally, employment and production move together, but there are times, such as today, where production can fall faster than employment or vice versa.

Bringing It Together

So far, we have outlined the entire Four Economy Framework, including the Leading, Cyclical, Aggregate, and Lagging Economy.

The Leading Economy gives us an early warning sign of future changes in growth and employment by tracking various measures such as real money supply growth, the yield curve, and new home sales.

The Cyclical Economy is the first time we measure growth and employment directly, but only for the construction and manufacturing sectors, as these two industries are the most sensitive to changes in monetary policy and have the largest booms and busts.

Within construction and manufacturing, there are a couple narrow sub-sectors that are the key drivers including residential construction and durable goods manufacturing.

It’s important to track these sub-sectors as standalone indexes as well as a Cyclical Economy collective.

Even more detail is created by analyzing Cyclical Economy employment and Cyclical Economy production.

If you’re able to analyze all these details, you’ll have an extremely precise understanding of exactly where the economy stands today, what the future risks are, and what may happen to the Aggregate Economy, which is the next part of our Business Cycle Sequence and the focus of the next blog post.

If you’re interested in these indexes, as well as a structured and repeatable process for tracking the Business Cycle, click the link to learn more about our Business Cycle Research services for investors and corporate management teams.

If you found this post interesting, please share it, and don’t forget to enter your email below so you receive the next article in your inbox!